Eric Galatas, WYOMING NEWS SERVICE. – Consumer groups in Wyoming are pressing lawmakers to keep the lights on at the Office of Consumer Advocate (OCA). The office represents customers when their utility companies want to raise rates.

In 2013, legislators voted to extend the OCA until 2023, but Senate File 78, sponsored by Majority Leader Sen. Eli Bebout, could close the agency as early as 2018.

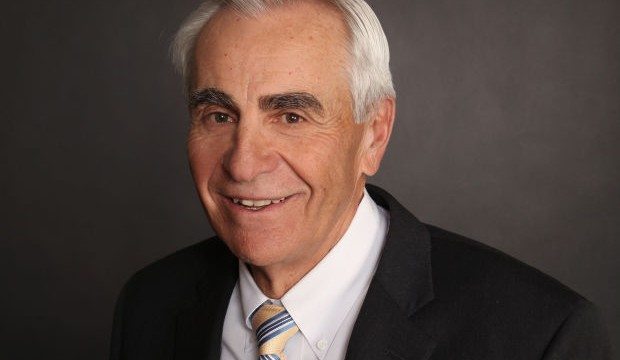

Ronald Lopez, a Wyoming attorney who has intervened in cases involving the OCA on behalf of utility companies, businesses and consumers, thinks closing the office is a bad idea for utility ratepayers.

“The Office of Consumer Advocate has the training, expertise and knowledge to be able to assess the issues that are associated with utility rate cases,” says Lopez, “and to be able to advocate on behalf of consumers and give them a voice within those procedures.”

Lopez says without the OCA, utility companies would be able to argue essentially unopposed for rate increases presented to the Public Service Commission, the state agency that regulates telecommunications and energy.

Chris Brown, administrator at the Wyoming Telecommunications Association, says the group is monitoring the measure but has not taken a formal position.

According to Lopez, a typical ratepayer contributes about five cents a month to fund the OCA, which has a staff of six. He says even though they’re experts in complex utility issues, they face well-financed cable, telephone and energy companies in rate-hike cases.

If the OCA closes, Lopez warns an already uneven playing field would be tipped further against consumers.

“Especially those people who live on fixed incomes,” he says. “Without the OCA, rates may go up even higher than they would under a normal rate-making process, where the OCA is present and can advocate on behalf of those individuals.”

The measure cleared its second hearing in the Senate on Friday. A third hearing is expected this week before the legislation advances to the House